Grim news coming in from Sicily, Italy. Mike Lynch, the U.K. investor and founder of IT company Autonomy, has been identified as one of two bodies recovered from the Bayesian, the yacht that sunk off the coast of Sicily early Monday, according to several reports coming out of the country that cite the Chief of […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Grim news coming in from Sicily, Italy. Mike Lynch, the U.K. investor and founder of IT company Autonomy, has been identified as one of two bodies recovered from the Bayesian, the yacht that sunk off the coast of Sicily early Monday, according to several reports coming out of the country that cite the Chief of Civil Protection, Salvo Cocina.

Lynch’s daughter, Hannah, has also been identified.

The news caps off a grim few days of events. The boat, registered to Lynch’s wife, Angela Bacares, quickly capsized in the early hours of Monday after it was struck by a tornado-like water column. Bacares was among the 15 survivors, but three bodies have now been found and four more are still being recovered from the wreck. Those yet to be found include the international chairman of Morgan Stanley bank, his wife, a lawyer from New York who worked with Lynch, and his wife.

As we previously reported, the Bayesian was on a voyage to celebrate Lynch’s acquittal in a criminal fraud trial in the U.S. earlier this summer. That trial also involved a co-defendant, Stephen Chamberlain. In a tragic coincidence, Chamberlain was hit by a car last Saturday and died of his wounds earlier this week.

Lynch was one of the most well-known and colorful figures in the U.K. technology world — sometimes referred to as the “Bill Gates of U.K. tech.”

HP acquired Lynch’s enterprise technology firm Autonomy in 2011 by for $11 billion — a major milestone for U.K. technology and one of the biggest tech M&A deals at the time. But it quickly turned sour, and HP sued Lynch and Autonomy’s director of finance, Chamberlain, arguing it was misled in the transaction.

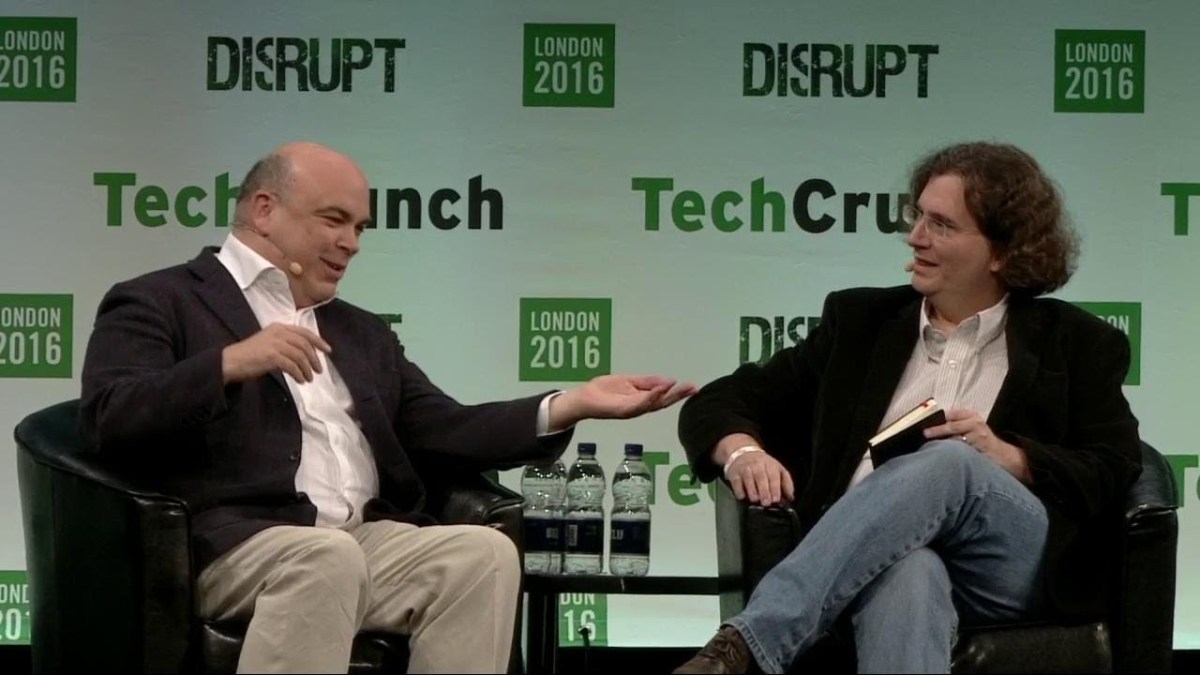

HP claimed that the deal led to a $4 billion loss — money it then demanded from Lynch and Chamberlain. Lynch (pictured above, left) and his co-defendant long asserted that they acted in good faith and were being made into scapegoats over a merger gone bad.

That legal drama went on for more than a decade and involved a host of other thorny chapters, including Lynch’s extradition to the U.S. and a lot of very bad publicity for him. It also led to a second civil case that took place in 2022 in the U.K., which Lynch lost.

The U.S. criminal case, where Lynch and Chamberlain were charged with 15 counts of fraud and conspiracy and could have spelled jail for the pair, went to trial earlier this year in San Francisco. Then finally, in June, Lynch and Chamberlain were acquitted.

In the interim years, Lynch built up a profile in the U.K. as a prominent investor, most prominently as the founder of Invoke Capital.

The VC firm was the biggest investor in cybersecurity firm Darktrace, a connection that was not without its own controversy. It also invested in Sophia Genetics, Featurespace and Luminance, among others. And it appeared that this is the route that he had been planning to continue to pursue.

“I am elated with today’s verdict and grateful to the jury for their attention to the facts over the last ten weeks. My deepest thanks go to my legal team for their tireless work on my behalf,” Lynch said at the time of the acquittal. “I am looking forward to returning to the UK and getting back to what I love most: my family and innovating in my field.”

Our thoughts go out to Lynch’s (and Chamberlain’s) family, friends and colleagues. We have also reached out to Lynch’s spokespeople and will update this post as we learn more.

Leave a Reply