The VCs who long ran GGV Capital have settled on two new brands, roughly six months after announcing they would split their U.S. and Asia operations.

© 2024 TechCrunch. All rights reserved. For personal use only.

The VCs who long ran GGV Capital, the 24-year-old cross-border firm that helped serve as a bridge between the U.S. and China, have settled on two new brands roughly six months after announcing they would split their U.S. and Asia operations.

Veteran investors Jenny Lee and Jixun Foo just rebranded their Singapore-based operation as Granite Asia, as first reported in Forbes. Meanwhile, Hans Tung, a firm co-founder who lives in the Bay Area, announced on X on Saturday that the U.S. team is now called Notable Capital.

GGV Capital announced last fall that it was splitting up its team amid growing tensions between the U.S. and China, though it never cited the atmosphere as the explicit driver of the move.

Sequoia Capital similarly split up its operations last year as it navigated geopolitical tensions. In Sequoia’s case, the U.S. team held onto the storied brand, while Sequoia India & Southeast Asia was rebranded as Peak XV Partners, and Sequoia China was rebranded as HongShan, the Mandarin word for redwood.

The thinking in abandoning the GGV Capital brand, per a source familiar, was that because both teams are operating separately going forward, they felt it was best to develop new brands.

Granite Asia is being led by Lee and Foo, native Singaporeans. Lee is a regular fixture on Forbes’s Midas List of top-performing VCs, with nine IPOs in the last five years, including the smart phone giant Xiaomi and the software development company Kingsoft WPS, which went public in 2018 and 2019, respectively.

Foo, whose title was formerly global managing director of GGV Capital, is meanwhile credited with deals that include the electric carmaker Xpeng Motors, which went public in 2020; ride-hail giant Didi, which is reportedly planning a listing in Hong Kong this year; and the delivery company Grab, whose shares have underperformed since it became publicly traded through a special purpose acquisition vehicle in late 2021. (It was reportedly in talks as recently as last month to merge with another beleaguered rival, GoTo Group.)

Granite Asia will focus on startups in China, Japan, South Asia, Australia and Southeast Asia.

Notable Capital — which says it plans to continue investing in the U.S., as well as in Europe and Latin America — is being led by the same investors who’ve been based in its Menlo Park office for many years. That includes Tung, who is Taiwanese-American and whose deals include known brands like Airbnb, StockX and Slack; Jeff Richards, who has backed Coinbase, the Bluetooth-tracking outfit Tile, and the software development company Handshake; and Glenn Solomon, whose deals include HashiCorp, whose software helps companies operate in the cloud (it’s reportedly weighing a sale right now); the publicly traded house-buying platform Opendoor; and the compliance automation startup Drata.

Oren Yunger, the newest member of GGV Capital, also remains on team Notable. Yunger had joined GGV as an investor in 2018 and was promoted to managing director last fall.

Another longtime managing director at GGV Capital, Eric Xu, who is based in Shanghai, will continue to oversee the original firm’s independently operated yuan-denominated funds.

Roughly two-and-a-half years ago, GGV Capital announced it has raised $2.5 billion for its new funds, marking its largest family of funds ever. The investors have since split those assets under management, along with the capital raised prior, such that Granite Asia is now managing a collective $5 billion altogether, leaving Notable Capital with roughly $4.2 billion based on GGV Capital’s assets under management at the time the split was announced.

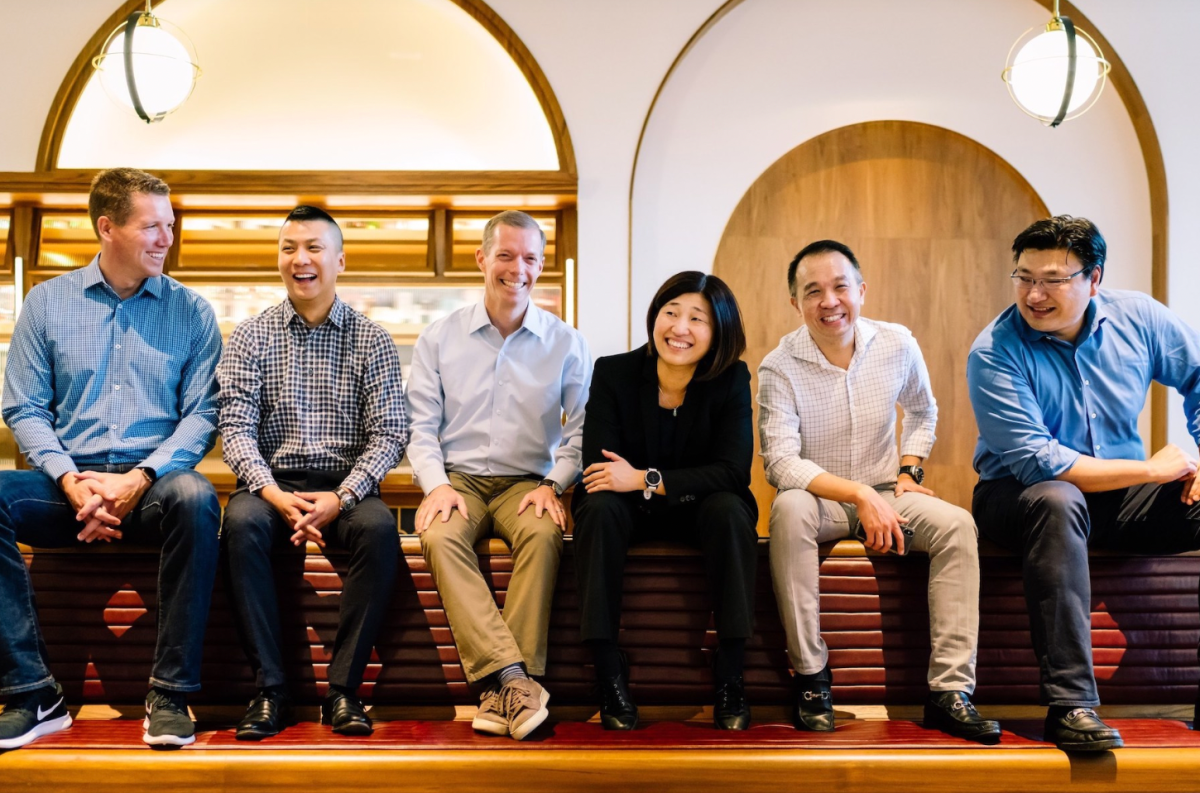

Pictured above, left to right: Jeff Richards, Eric Xu, Glenn Solomon, Jenny Lee, Jixun Foo, and Hans Tung

Leave a Reply