There is perhaps no bigger jump for a startup to make than from the incubatory seed stage to its Series A round. Given how large a step-up landing a Series A can be, there are many guidelines out there. But most seem to be a little outdated in today’s market. The venerable rule that a […]

© 2024 TechCrunch. All rights reserved. For personal use only.

There is perhaps no bigger jump for a startup to make than from the incubatory seed stage to its Series A round. Given how large a step-up landing a Series A can be, there are many guidelines out there. But most seem to be a little outdated in today’s market. The venerable rule that a startup should have $1 million in annual recurring revenue or equivalent, for example, seems anachronistic today. After all, some companies have raised in recent quarters with less, while others with more struggled to attract capital.

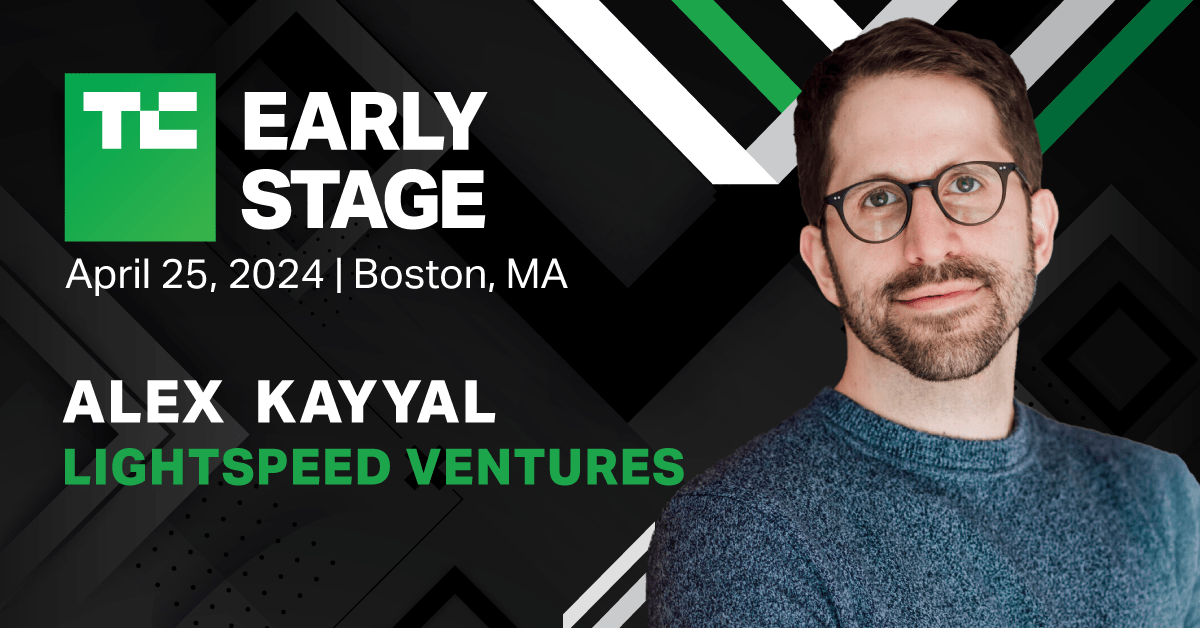

Enter Lightspeed Venture Partners’ Alex Kayyal, who is coming to TechCrunch Early Stage 2024 to discuss how startups can avoid common pitfalls on the path to raising their own Series A.

Not that raising an A round was ever easy — how many times have we discussed a Series A crunch at TechCrunch over the years? A startup’s first lettered round is when big dreams and potentially bigger markets run directly into venture expectations like sales repeatability, CAC payback, and the like. It’s akin to going from middle school to graduate school in a single leap.

So, bring a notebook because Kayyal — formerly of Salesforce Ventures, and a backer of companies like Gong and Algolia — is bringing his insight to our shindig. And, of course, as with all TechCrunch Early Stage events, he’ll answer questions directly.

Ticket prices increase on March 29. Book your tickets now and save $200 before we go into late-bird pricing.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024? Reach out to our sponsorship sales team by completing this form.

Leave a Reply