The bankruptcy of banking-as-a-service (BaaS) fintech Synapse shows just how treacherous things are for the often-interdependent fintech world when one key player hits trouble. Synapse’s problems have hurt and taken down a number of other startups and affected millions of consumers all over the country. Many believe regulatory clarity is needed moving forward. One analyst […]

© 2024 TechCrunch. All rights reserved. For personal use only.

The bankruptcy of banking-as-a-service (BaaS) fintech Synapse shows just how treacherous things are for the often-interdependent fintech world when one key player hits trouble.

Synapse’s problems have hurt and taken down a number of other startups and affected millions of consumers all over the country. Many believe regulatory clarity is needed moving forward. One analyst says the case of Synapse underscores the need for fintech companies to maintain high operational and compliance standards.

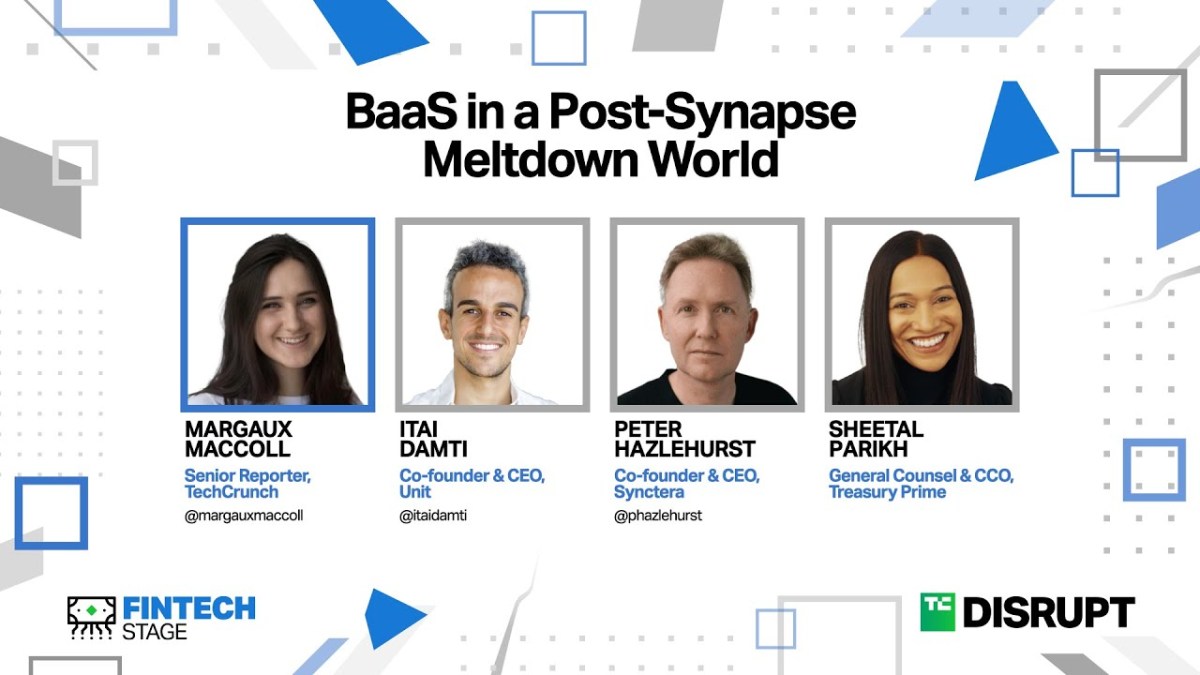

This panel with Unit Co-Founder & CEO Itai Damti, Synctera Co-Founder and CEO Peter Hazlehurst, and Treasury Prime General Counsel & CCO Sheetal Parikh discusses the potential impacts the Synapse collapse will have on the future of BaaS.

#TechCrunchDisrupt2024 #Technology #Startups

Subscribe for more on YouTube: https://tcrn.ch/youtube

Follow TechCrunch on Instagram: http://tcrn.ch/instagramTikTok: https://tcrn.ch/tiktokX: tcrn.ch/xThreads: https://tcrn.ch/threadsFacebook: https://tcrn.ch/facebookBluesky: https://tcrn.ch/blueskyMastodon: https://tcrn.ch/mstdnRead more: https://techcrunch.com/

Leave a Reply