Customers of WazirX, the Indian cryptocurrency exchange that suffered a $234 million hack in July, are unlikely to recover their funds in full through the ongoing restructuring process, a company legal adviser said on Monday. George Gwee, a director at restructuring firm Kroll working with WazirX, said that at least 43% of the money any […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Customers of WazirX, the Indian cryptocurrency exchange that suffered a $234 million hack in July, are unlikely to recover their funds in full through the ongoing restructuring process, a company legal adviser said on Monday.

George Gwee, a director at restructuring firm Kroll working with WazirX, said that at least 43% of the money any customer had in WazirX is unlikely to be recovered. Last week, WazirX asked a Singapore High Court for six months’ protection while it restructures its liabilities.

The best case scenario is a return of “anywhere between 55% and 57% of the funds,” Gwee told journalists. Under a restructuring, WazirX’s priority will be to distribute remaining token assets to users in a pro-rata manner via crypto, it said. The company is holding discussions to share profit from its revenue-generating products, it added, without giving any concrete details.

The hack, which occurred in July, is the largest cryptocurrency theft in India to date and has sent shockwaves through the country’s crypto industry. The company has been scrambling to find ways to return money to its customers ever since. In July, it proposed that it would socialize the “force majeure” loss.

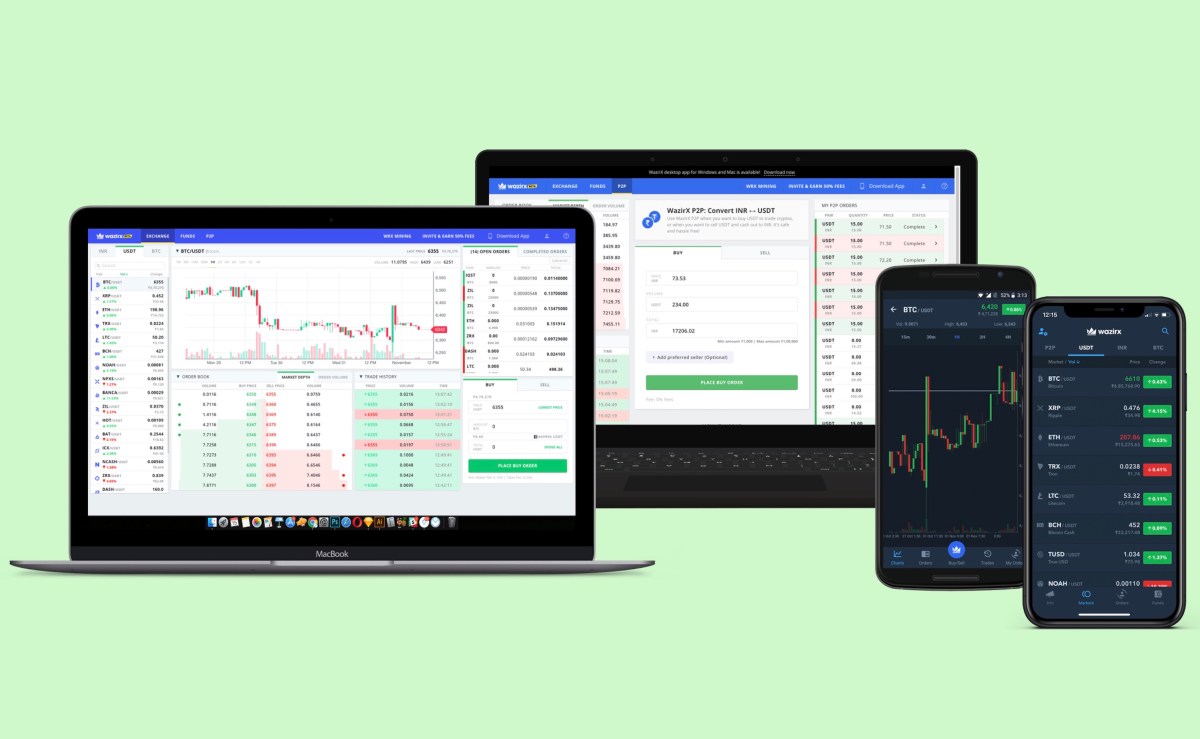

WazirX’s assets as of August 24. Image Credits: WazirX / YouTube

During the press conference, WazirX representatives avoided many questions about its efforts to shore up capital. The company said it’s holding talks with an unnamed white knight, but said the capital won’t be raised against equity because of an ongoing dispute with Binance, the world’s largest cryptocurrency exchange — Binance and WazirX have been closely linked at some point.

In late 2019, Binance announced the acquisition of WazirX in a blog post, but later disputed that it had acquired the firm. After a public row, the cryptocurrency exchange terminated its tech offerings to the Indian firm in 2022.

Asked about Binance’s ownership of WazirX, the Indian firm declined to comment. When questioned about selling WazirX as part of the restructuring, the company representatives stated that such a sale was not possible.

Asked if the firm could pursue legal actions against Binance and Liminal, the multisignature wallet provider whose system was allegedly compromised during the hack, WazirX representatives had no clear answer.

The pressure is mounting WazirX as CoinSwitch, another major Indian crypto exchange, initiated legal action against WazirX last week to recover approximately about $9.7 million worth of assets stuck on WazirX’s platform.

WazirX counts Indian law enforcement agencies among its customers.

Leave a Reply