CRED, an Indian fintech startup, has rolled out a new feature that will help its customers manage and gain deeper insights into their cash flow, as the startup seeks to drive engagement through personal finance tools. Known primarily for its credit card bill payment and consumer lending service, the new feature of the Bengaluru-based startup […]

© 2024 TechCrunch. All rights reserved. For personal use only.

CRED, an Indian fintech startup, has rolled out a new feature that will help its customers manage and gain deeper insights into their cash flow, as startup seeks to drive engagement by providing much-needed personal finance tools.

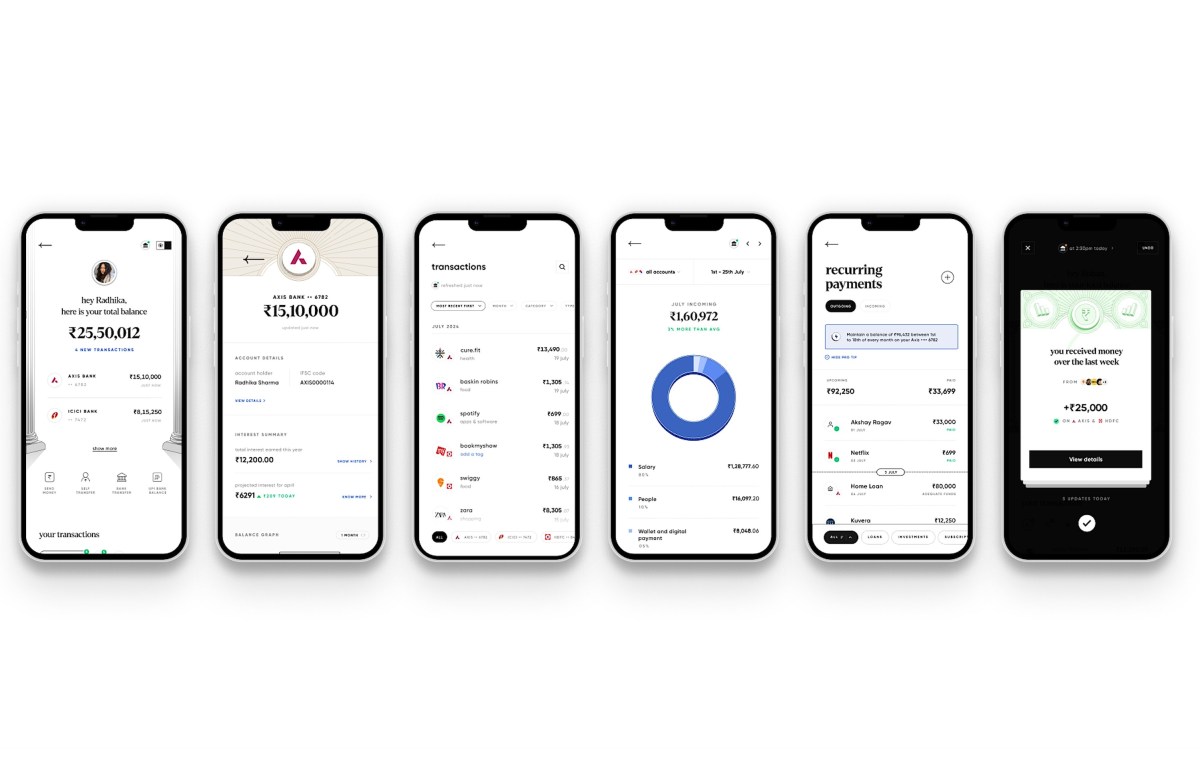

Known primarily for its credit card bill payment and consumer lending service, the Bengaluru-based startup is venturing into personal finance management with the new feature it’s calling CRED Money.

CRED Money consolidates users’ financial data from all their bank accounts, enabling them to track their bank transactions and recurring payments (including SIP investments, rent and staff salaries) on one dashboard. Users can also look up for transactions by merchants or categories and can also get reminders.

The startup said the feature leverages India’s account aggregator framework, a financial data-sharing system introduced by the Reserve Bank of India to enhance transparency and user control over personal financial information. This framework allows consumers to grant temporary, purpose-specific access to their financial data across multiple institutions through a standardized, encrypted channel.

The startup said it won’t be monetizing the new feature.

CRED, valued at $6.4 billion, said the feature employs data science algorithms to analyze the high volume of transactions conducted by its users across multiple accounts. The platform aims to turn this information into brief actionable insights, potentially helping users identify spending patterns, investment opportunities, and areas for financial optimization.

CRED claims that nearly 70% of India’s affluent population struggles with having their finances fragmented across multiple platforms, which is made worse because the average customer makes about 200 transactions a month. This administrative overhead can lead to suboptimal decision-making and potentially impact credit scores.

“More money, more problems,” said CRED founder Kunal Shah in a statement. “We have built a product that improves every affluent person’s relationship with money and makes them less anxious about it through a trusted, insightful experience,” he added.

CRED has positioned itself as a platform for rich, creditworthy consumers since its launch. But like any other demographic, this one is also not immune to financial mismanagement. Many users often neglect to review their bank statements, disregard important notifications from banks, and incur penalties for late payments.

CRED Money, launching in phases from Thursday, is the latest in a series of additions by the startup. It has been steadily broadening its portfolio, recently acquiring Kuvera, a platform for mutual fund and stock investments. CRED’s product development process involves extensive internal testing, with new features undergoing months of employee trials before customer release. This approach ensures that only features demonstrating clear value reach the wider user base, CRED executives said.

Leave a Reply