GrayMatter self-reports that its systems currently produce “a 2~4x improvement in production line productivity [and a] 30% or more reduction in consumable waste.”

© 2024 TechCrunch. All rights reserved. For personal use only.

Robotics funding has broadly cooled off since its 2021-2022 peaks, but plenty of the issues exposed by the pandemic remain firmly in place. The biggest push behind venture funding in the category is an ongoing labor shortage. Analyst firm Garner forecasts that by 2028, half of large enterprise companies will employ robots in their warehouse and manufacturing processes.

The other key factor that warehouse/logistics robotics has going for it is a proven track record. While many approaches to automation presently have theoretical ROI, warehouse robots are out there doing the work right now, from Amazon on down.

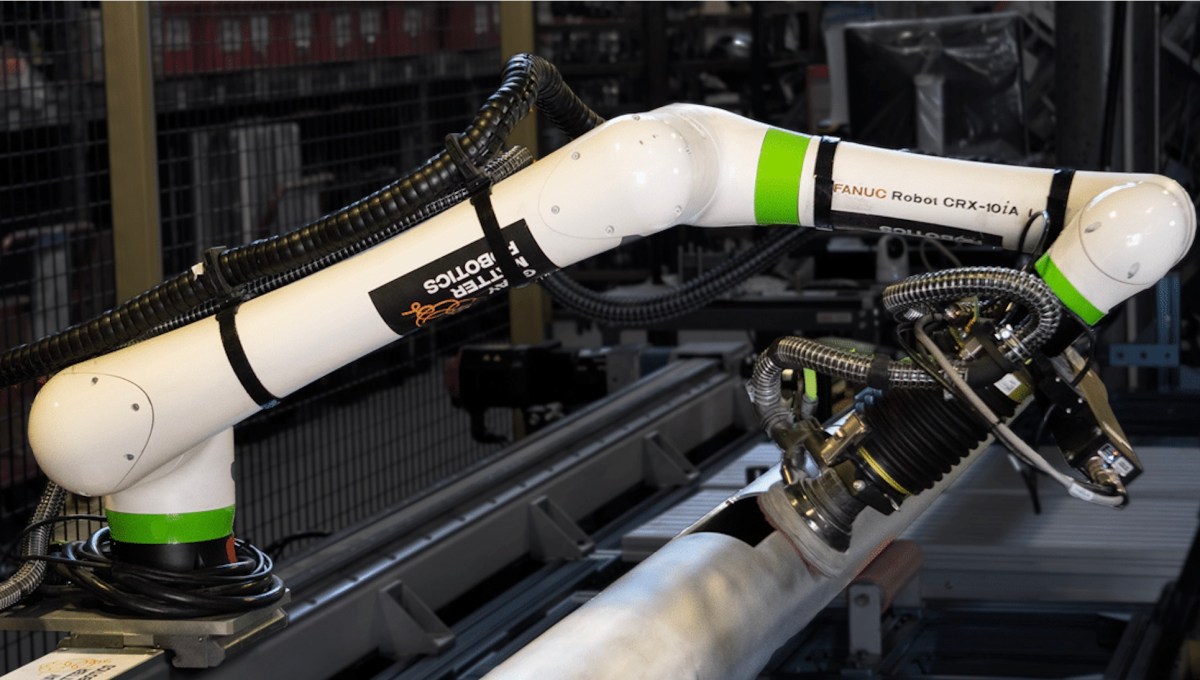

GrayMatter is among those with a prove track record in the field. The Southern Californian firm self-reports that its systems currently produce “a 2~4x improvement in production line productivity [and a] 30% or more reduction in consumable waste.” Big names including Boeing and 3M currently utilize its systems.

This is all in spite of the fact that GrayMatter is a young company, having only been founded toward the outset of the pandemic in 2020.

“We founded GrayMatter to enhance productivity while prioritizing workforce well-being,” co-founder and CEO Ariyan Kabir says in a release. “With our physics-based AI-powered systems, we are fulfilling our mission while unlocking new levels of efficiency and productivity. With our investors’ support, we are making a real difference for shop workers and addressing the critical labor shortages in manufacturing today.”

What, then, is a “physics-based” robotics system? GrayMatter contrasts its approach from the purely data-driven method used by others. The company explains:

Consider the problem of predicting process output based on the input. If the output is expected to increase with an increase in the input, then the underlying model space is limited, and a smaller amount of data can train it. We don’t need to consider arbitrarily complex models. On the other hand, this requires more complex representations and associated solution generation methods to handle constraints to produce acceptable computational performance. We cannot train a simple neural network with observed input and output data. In this case, there is no guarantee that it would preserve the process constraint if the output used during training is noisy.

Interest in the company has propelled growth. GrayMatter is a regular in our robotics job opening posts. The roundup we posted in May listed 20 open roles, among the highest of those listed.

That growth, in turn, is supported by ongoing funding. On Thursday, GrayMatter announced a $45 million Series B round, led by Wellington Management, with participation from NGP Capital, Euclidean Capital, Advance Venture Partners, SQN Venture Partners, 3M Ventures, B Capital, Bow Capital, Calibrate Ventures, OCA Ventures and Swift Ventures. The round nearly doubles the $25 million Series A the company closed in 2022.

Leave a Reply