Ansa, a startup that helps merchants develop and offer branded virtual wallets, has raised a $14 million Series A round of funding, the company has told TechCrunch exclusively. Renegade Partners led Ansa’s latest financing, which included participation from existing backers Bain Capital Ventures, BoxGroup and Wischoff Ventures and new investor B37 Ventures. With this latest […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Ansa, a startup that helps merchants develop and offer branded virtual wallets, has raised a $14 million Series A round of funding, the company has told TechCrunch exclusively.

Renegade Partners led Ansa’s latest financing, which included participation from existing backers Bain Capital Ventures, BoxGroup and Wischoff Ventures and new investor B37 Ventures. With this latest raise, Ansa has raised a total of nearly $20 million in venture capital, including a $5.4 million seed round. The company declined to reveal its current valuation, saying only the Series A was raised “with a significant valuation multiple.”

Notably, female investors — including Renegade Partners’ Renata Quintini, Wischoff Ventures’ Nichole Wischoff, Bain Capital’s Christina Melas-Kyriazi, BoxGroup’s Nimi Katragadda from BoxGroup and former Affirm exec Silvija Martincevic — contributed 95.6% to the Series A round, the company said.

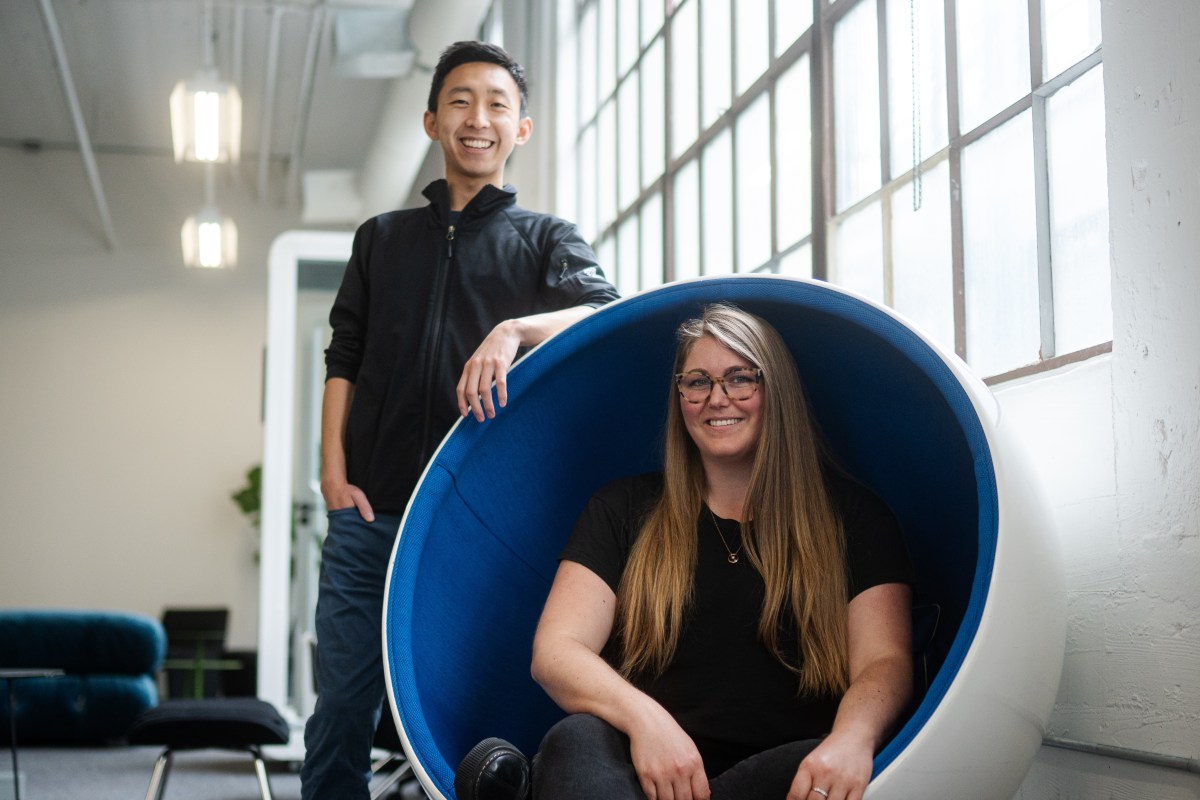

Founded in 2022 by former Adyen product manager Sophia Goldberg and ex-Affirm software engineer JT Cho, San Francisco-based Ansa is building what it describes as a white-labeled digital wallet infrastructure to help businesses process small payments and offset high credit card fees for smaller transactions.

Or as Goldberg describes it, Ansa is building a “wallet-as-a-service,” or embedded customer balances to let any merchant launch a branded flexible payment instrument.

That can look like the Starbucks in-app payment experience where a customer loads funds. It can also allow a merchant to fund with incentives or refunds. Ansa claims that by using its API-first platform, a merchant can create a wallet “within weeks rather than quarters.”

“Branded customer wallets enable merchants to offer a payment solution which fits their use cases better, while driving customer loyalty and frequency,” CEO Goldberg told TechCrunch. “Additionally, merchants can enhance revenue streams and foster customer loyalty. With Ansa, merchants can drive adoption of their wallets by integrating customer balances with rewards, incentives, and their other loyalty initiatives.”

Ansa is focused on the coffee, quick service restaurant (QSR) and marketplace verticals as its initial core markets. Retail and convenience stores are other target markets.

The use of a branded wallet also helps these types of merchants avoid paying credit card fees, which can be high, especially relative to the dollar amount of some of the purchases.

For example, Goldberg noted that a $4 latte paid for with a credit card can incur additional costs exceeding 12.5%. A typical e-commerce transaction could be 2.9% and $0.30. The fixed fee is extremely impactful on smaller transactions, Goldberg contends, as it represents a higher percentage when the transaction size is smaller.

“A 30 cents fee on a $5 transaction is a higher percentage of the total revenue and will impact margins more than it would on a $100 transaction,” Goldberg added. “For merchants with narrow margins, these fixed fees can significantly cut into revenue.”

Image Credits: Ansa

In the first quarter of 2024, Goldberg said that the startup doubled its customer base compared to the previous year, although she declined to reveal hard customer or revenue figures.

Ansa monetizes through a mix of platform fees and a markup on the transaction.

“We’re part-infrastructure, part-revenue generation, and so we bill on service and value-add,” Goldberg said.

The funding will largely go toward product development and engineering. Presently, the company has 12 employees and is hiring.

Renegade Partners’ Quintini told TechCrunch that her firm’s investment in Ansa marks its largest first check to date.

“Because Ansa integrates with most modern PSPs (preferred service providers), including Square, Stripe and Braintree, new merchants can ramp up right away to begin driving both loyalty and operational efficiency,” she told TechCrunch, adding that the tech helps “any merchant to deliver a seamless, Starbucks app-like experience to their customers.”

Want more fintech news in your inbox? Sign up for TechCrunch Fintech here.

Leave a Reply