Madica, an investment program launched by US-based investor Flourish Ventures to back pre-seed startups in Africa, plans to invest in up to 10 ventures by the end of the year, ramping up its funding efforts after closing three initial deals. Madica disclosed the plans to TechCrunch indicating accelerated investing in the coming year as it […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Madica, an investment program launched by US-based investor Flourish Ventures to back pre-seed startups in Africa, plans to invest in up to 10 ventures by the end of the year, ramping up its funding efforts after closing three initial deals.

Madica disclosed the plans to TechCrunch indicating accelerated investing in the coming year as it eyes up to 30 startups by the end of its three-year program, which started mid last year, after launch late 2022.

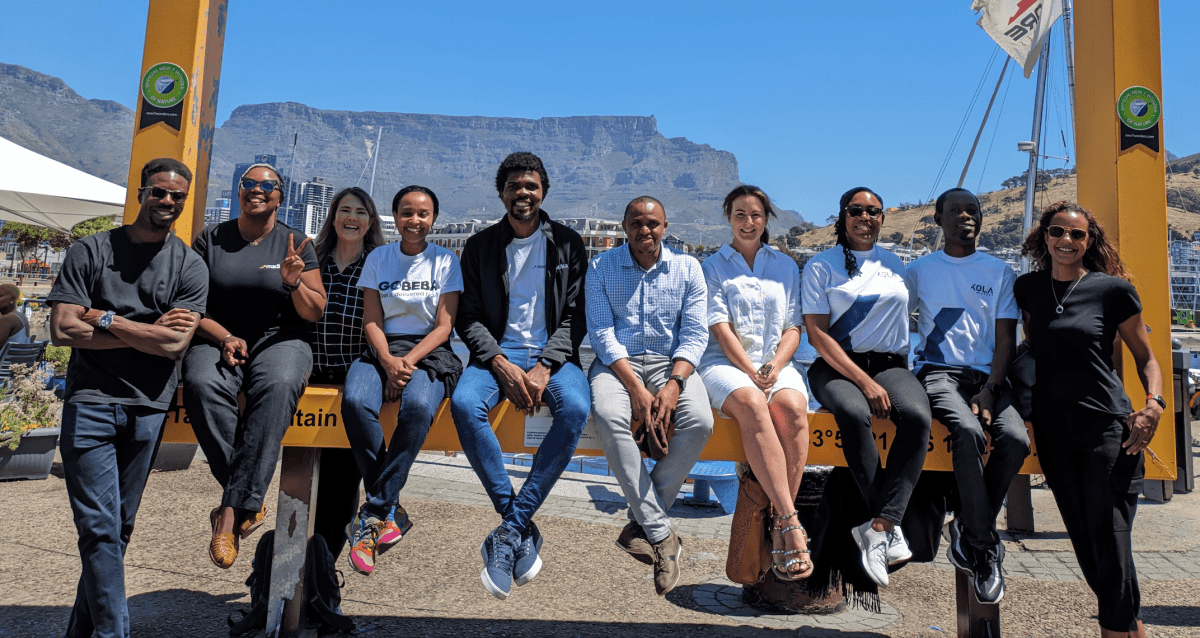

Announced today, the program’s initial investees include Kola Market, a B2B platform founded by Marie-Reine Seshie to help SMEs grow their sales and simplify their business operations. Others are GoBEBA, a Kenyan on-demand retailer of household goods founded by Lesley Mbogo and Peter Ndiang’ui, and Newform Foods (formerly Mzansi Meat) a South African cultivated meat startup founded by Brett Thompson and Tasneem Karodia.

More are set to join the program, as Madica explores potential deals in budding markets such as Tunisia, Morocco, Uganda, DRC, Rwanda and Ethiopia. This is in line with its plan to reach startups in diverse sectors and markets, as well as those run by underrepresented and underfunded founders. Madica is further looking beyond fintechs, the most-funded sector in Africa, and is also keen on backing startups by women founders (or where at least one founder is a woman), a demographic that continues to receive measly VC funding.

“I believe that with the number of challenges that exist across the continent, it’s the entrepreneurs who are in those markets that understand the context and have lived experiences around those issues that are best positioned to solve those challenges. The point of the Madica program is to actually prove and show that it’s possible to find founders that are building good businesses but don’t fit the usual homogeneous group,” said Emmanuel Adegboye, Head of Madica.

Madica invests upfront, to a tune of $200,000, once a venture is accepted into the program, which runs for up to 18 months, and also involves tailored hands-on support and mentorship. It has set aside $6 million to invest in scalable tech-enabled business and an equal amount to run the first phase of the program, which has rolling admission. The program does not have standard terms for investment making each deal unique.

“Our programming is both very personalized, but also structured in some ways because founders come into the program at different points. The personalized part of the program is super critical because we want to understand what they need and how we can best support them,” said Adegboye.

“But we also recognize that at every point in time, we’re going to have at least a few companies we’re working with within the program so we have a few parts of the program that are very structured and that cuts across every company within the portfolio,” he said.

Adegboye hopes that as the program catalyzes investments in the pre-seed stage across different ecosystems in Africa, Madica can attract more capital into the continent and eventually serve as a reference for global VCs intending to scale operations in the market.

“Depending on how the program goes, there is a possibility that we will double down on it or open it up to other partners to join us and accelerate this mission.”

Leave a Reply