The Reserve Bank of India issued new curbs against Paytm’s Payments Bank, which processes transactions for financial services giant Paytm, barring it from offering many banking services including accepting fresh deposits and credit transactions across its services. Wednesday’s move, which goes into effect February 29, follows the Indian central bank ordering Paytm Payments Bank to stop […]

© 2024 TechCrunch. All rights reserved. For personal use only.

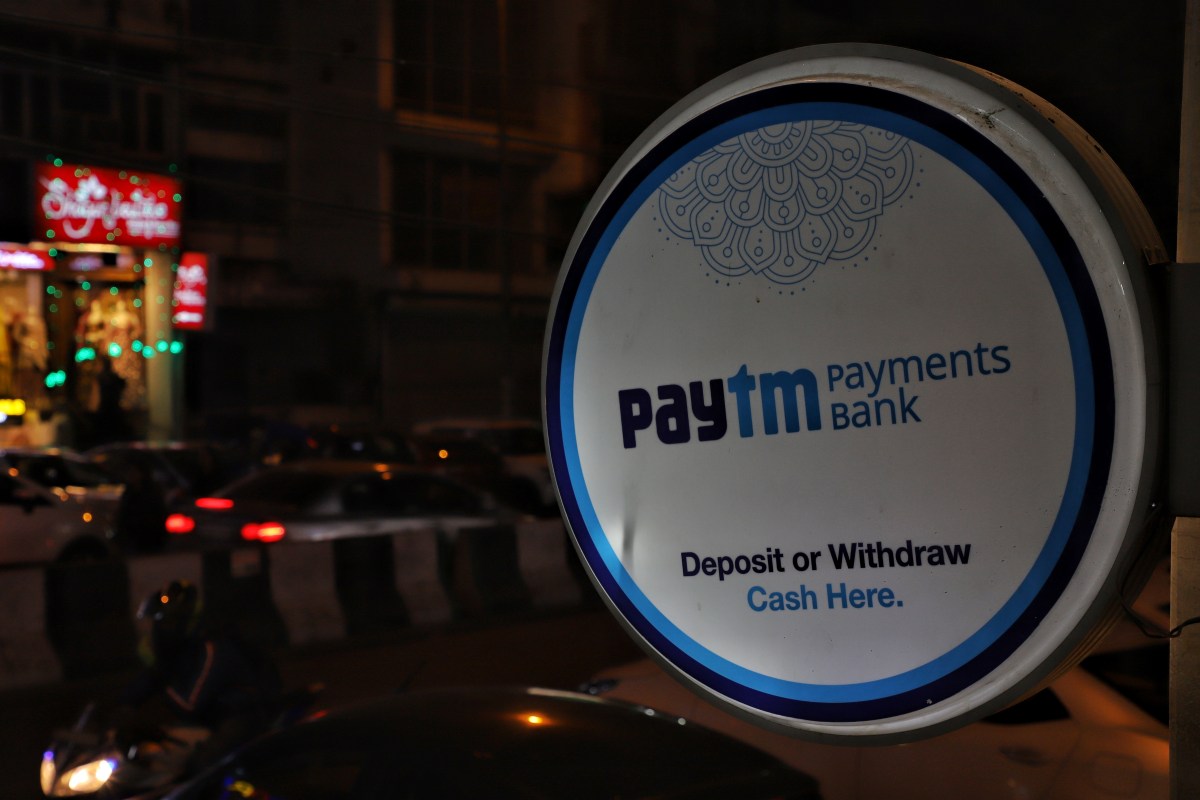

The Reserve Bank of India has ordered Paytm’s Payments Bank to cease deposits, credit transactions and top-ups in customer accounts, prepaid instruments and wallets after February 29 in new strict penalties after the central bank found the firm to be in non-compliance with an earlier embargo.

Wednesday’s move follows the Indian central bank ordering Paytm Payments Bank to stop accepting new customer accounts in 2022. RBI said a comprehensive audit by external auditors found “persistent” non-compliances and “continued material supervisory concerns” in the bank.

Paytm’s Payments Bank will also cease banking services — including fund transfers, UPI transactions — after February 29, RBI said in a press release (PDF). It has also directed One97 Communications, the parent firm of Paytm, and Paytm Payments Services to terminate their nodal accounts “at the earliest.” Customers can continue to withdraw money from their accounts, RBI said.

Without the nodal account, Paytm will likely have to move many of its businesses to other banks, according to preliminary assessment by industry executives.

More to follow.

Leave a Reply